Want to master the top forex chart patterns that boost trading success? Chart patterns are the best and ultimate opportunities in the forex market jungle. Forex chart patterns provide valuable insight into the market’s underlying psychology and potential future prices. Understanding and identifying these trends is essential for making better decisions and developing profitable forex trading strategies. They are crucial for forex trading robots, enabling them to recognize market trends.

While trading financial assets in the forex market, profit and loss are made from price movements by understanding forex chart patterns, covering new complexities of the forex market, and making well-informed trading decisions. In this article, we will discuss chart patterns, common types of forex chart patterns, reversal chart patterns, and their disadvantages.

Let’s dive in!

What Is A Chart Pattern?

A chart pattern is a set of price actions that repeat over time. In other words, it is a graphical representation of price movement using a series of trend curves or lines. These patterns are natural phenomena in the financial market, influenced by various factors. Typically, price patterns are represented by candlesticks, and over time, candlestick patterns form on trading charts, telling the story of price action in underlying assets. These patterns are powerful tools for technical analysis, providing insight into market conditions and helping traders identify lucrative opportunities with minimal risk exposure. These charts benefit AI trading as they help algorithms identify potential market trends.

The main aim behind chart pattern analysis is to learn about forex chart patterns so that individuals can guess what might happen when the same pattern reappears. The result of each chart pattern is based on whether it seems to be a volatile, bullish, bearish environment or a calm market.

How To Read Forex Chart Patterns?

Sometimes, if you are a beginner or professional then it is tricky to identify trading patterns or charts. Top patterns like triangle badge with bespoke star rating systems are updated every 15 minutes to highlight the top and emerging technical trade setups. Individuals can also manually apply stock chart patterns to trading charts as part of their trading tool collection. Trading chart patterns come in shapes to have pre-determined price actions like stock breaks out and reversals.

Recognizing trading forex chart patterns gives a committed advantage in the market or increases future technical analysis value, so before starting chart pattern analysis, read well different types of trading charts and their features individually.

Common Types Of Chart Patterns

Common types of forex chart patterns are as follows:

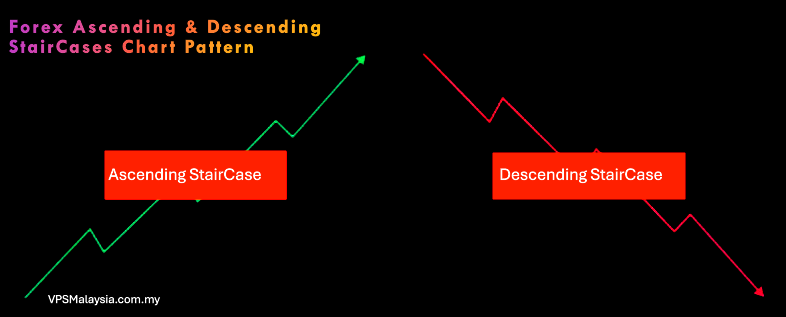

1. Ascending And Descending StairCases:

Ascending and descending staircases are among the standard and the best Forex chart patterns. It is knowing if individuals are interested in trading or identifying trends. For example, price action is rarely linear. There are often counter-movements against the prevailing trend, even within strong up or down trends.

In ascending staircases, the market shows upward movements. During occasional retracements, the market continues to rise, with even the lows being higher. This pattern occurs in bull markets, where traders stay involved until the uptrend ends. Dips in trends provide buying opportunities, allowing traders to enter the rally at a discounted price.

When the market forms lower lows and lower highs, known as a downtrend or descending staircase, traders consider short-side trading in this zone. During downtrends, traders often use mini rallies against the bearish move as opportunities to sell.

2. Ascending Triangle:

The other typical best forex chart patterns are the ascending triangles, used in technical analysis to identify trading opportunities. It is created by a horizontal set of highs that connect price highs series or upward-sloping trendlines with an ascending set of lows. The upper horizontal line is the resistance level, and the lower upward-sloping line is the support. The resulting pattern has a flat top or rising button that is familiar to triangles.

It is an upward trend appearing after an uptrend. Over the pattern course, the market consolidates and then breaks above the resistance line, and then a new uptrend should form. Because of the manipulation, sending triangle patterns is not a granny of future market movements. Traders often rush and draw tradelines incorrectly. The ideal trendline should be a 30-45 degree angle, which connects 2-3 higher rows.

3. Descending Triangle:

A descending triangle is a bearish chart pattern for identifying potential trading opportunities. It is a horizontal trendline pattern that connects a price-low series and a downwards-sloping frontline with a series of lower highs. The result looks like a triangle with a flat bottom and a falling top. The patterns break down horizontal support levels and potential downtrends when the price hits the apex of the triangle.

It is also in conjunction with some other technical analyses to work, like volume indicators and oscillators for minimizing race and signal confirmation.

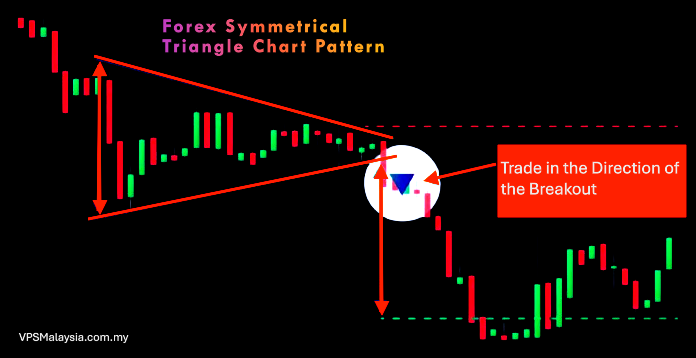

4. Symmetrical Triangle:

Symmetrical Triangles occur when the price of an asset is compared with a triangle pattern. It consists of two trend lines converging toward each other. The upper trend line connects to the series of lower highs, and the lower trend line connects to the higher lows. The 90% rule tells that 90% of traders lose money due to a lack of discipline and a solid strategy.

It Identifies the decision. Look for repeating price formations like triangle flags and use trendlines to outline and spot patterns in forex. In a market where sellers and buyers are in equilibrium, however, the pattern can be a continuation pattern for a reversal of the direction of the breakout.

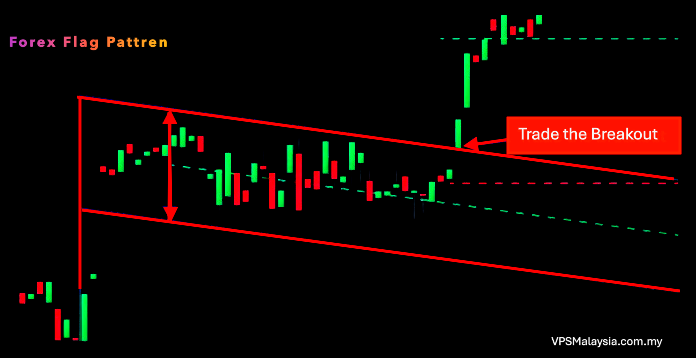

5. Flag:

Flag patterns come during strong uptrends and downtrends in the forex market. Forex chart patterns depend on the flag wall and flag. Their signal is taking a brief pose before continuing in the same direction. The flag pattern is a tool for identifying existing and ending points in the market. For example, traders leave a long position when the price breaks the resistance level of the flag or a short position where the price breaks below the support level of the flag.

These are short representations of poses where manipulation of prices is achieved. A trader must upload appropriate flags and then execute trades after these when your confirmation is gathered. Flags are one of the standard patterns that can be spotted.

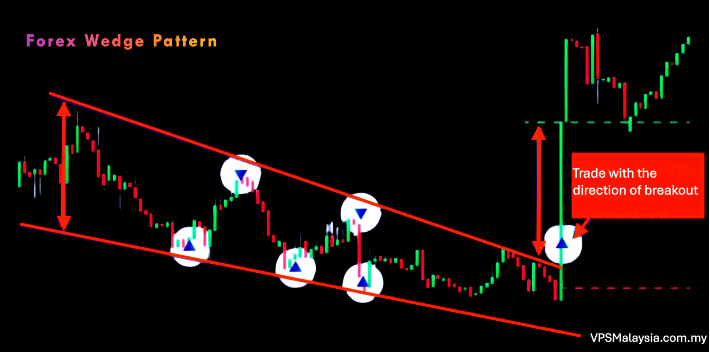

6. Wedge:

These are included in best forex chart patterns, which can be bearish or bullish depending on orientation. A falling wedge appears in an uptrend in the utilized market, followed by an uptrend and a breakout of wedge-shape consolidation. A rising batch forms when prices move high or low to form a triangle and wedge shape. These patterns are highly manipulated in today’s era, where quality values are observed to avoid manipulation based on hyper-strong trends. Wedges are continuation patterns, and prices continue in the direction of the previous trend after the pattern is complete.

7. Double Top:

Double top is a bearish reversal pattern after an uptrend in the market. Have two peaks in equal height with troughs. Its pattern is completed when the price breaks below the support level in the trough. The double-top pattern signals that market buying pressure is going weak, and the trend soon reverses or indicates that the assets’ current trajectory is about to change and move in another direction.

The double-top is a reliable Forex chart pattern. Other factors are considered to strengthen the view of a trend. When the neckline breaks, retail traders enter short positions, but the price often reverses, targeting the stop losses of these short sellers.

In the entry point of double top patterns, after the second peak, the price starts to retreat in the neckline, then enters the short position of the price bar in the neckline, which tells the potential beginning of a downward trend.

At the exit point of a double top, measure the distance between the neckline and the peak after measuring project distance towards a downward position from the neckline to launch a price target or to capitalize on potential trend reversal.

8. Double Bottom:

A double bottom is a bullish reversal pattern that occurs after a downtrend in the market, which is formed from two troughs with a peak equal in price and distance from the peak. The pattern is complete when the price breaks above the resistance level that connects two peaks in troughs. The double bottom pattern is a single; the selling pressure in the market is weakening, and the trend soon reverses. It represents a selling period and causes an asset price to drop below a level of support. Then, it rises to resistance before falling, and the trend reverses upward as the market becomes bullish.

Double bottom strength is stronger than the second bottom, where the higher lows are lower than the previous bottom. For example, the creator selects to enter a long position when the price breaks above the resistor level or exit a short position to minimize potential losses. Double bottoms are reliable in lower time frames. Thus, scalpers and day traders depend on quality double bottoms.

9. Head And Shoulders:

Another widely recognized trading strategy in forex chart patterns is the head and shoulders pattern. Head and shoulder patterns are considered one of the most reliable. It is designed for trend reversal identification by interpreting formation on the chart. This indicates a particular price of the central peak (head) surrounded by two lower peaks (shoulders).

The bottoming pattern consists of a shoulder retracement, followed by a head retracement, and then a second shoulder retracement.

The pattern is completed by the neckline, and the trendline connects two highs, and the bottoming pattern of two lows or the topping patterns of the formation are broken.

Traders can make decisions related to entry, exit, and trade management based on the head and shoulders pattern. Entry points are often determined when the pattern completes, marked by a break below the neckline. The neckline is a level drawn by connecting the lows between the head and the shoulders.

For exit point determination using head and shoulder patterns, measure the distance of the head’s highest point and neckline called pattern height. Project this distance downward from the neckline to establish a price target for the existing trade.

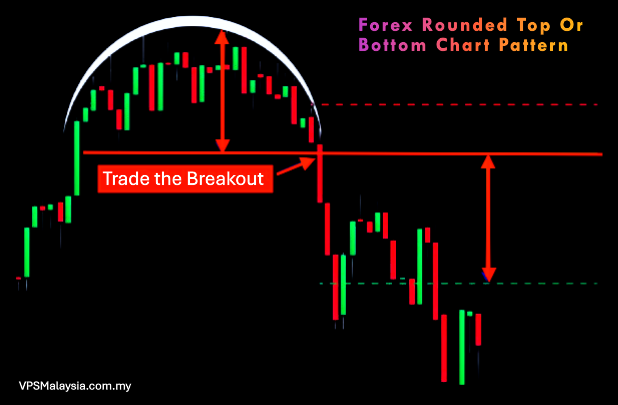

10. Rounded Top Or Bottom:

They represent a continuation or reversal pattern, often seen as a rounding during a trend, with a price pullback before rising again in a bullish continuation. A bullish reversal, known as a rounding bottom, occurs when a price in a downtrend forms a rounded shape before reversing direction and entering a bullish uptrend.

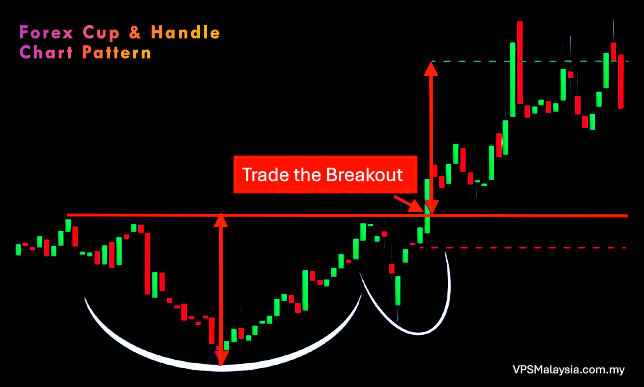

11. Cup And Handle:

The cup and handle continuation pattern shows a period of bearish market sentiment before the trend in a bullish motion. The cup and handle pattern comes like a rounding bottom chart pattern, expecting a second, smaller sip after it, and the handle is the same as the wedge pattern.

The smaller pattern looks like a flag pattern if the trend lines are parallel. The. The price enters a temporary retracement confined to two parallel lines on the price graph and continues with an overall bullish trend.

Reversal Chart Patterns

Chart patterns fall into two categories: reversal and continuation formations. Continuation patterns, such as ascending and descending triangles, flags, and pennants, signal the continuation of a prevailing trend after consolidation. Reversal patterns, including double tops and bottoms, inverse head and shoulders, and rising and falling wedges, indicate potential trend reversals. Bilateral patterns, like diamonds and rectangles, can lead to breakouts in either direction, depending on the context.

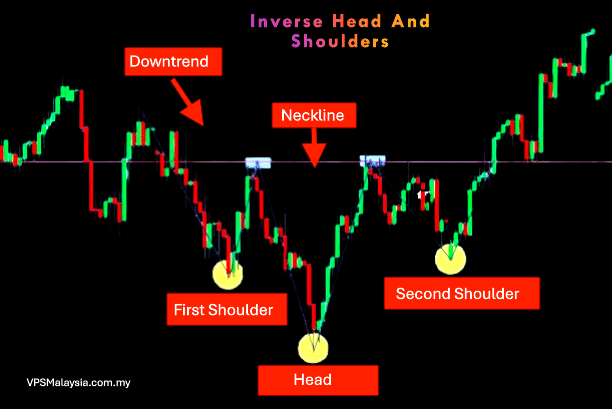

1. Inverse Head And Shoulders:

Inverse head and shoulder is a reversal chart pattern similar to the head and shoulder pattern except that it is inverted. It consists of successive lows, with the middle low (head) being depressed and the two outside lows (shoulders) being shallower. Two shoulders could be equal in height and width.

Its pattern of completion signals a bullish trend reversal. Traders enter a long position when the price rises above the neckline’s resistance. A downtrend begins with two lower lows (points 1 and 3) and two lower highs (points 2 and 4), forming the first and second bottoms. The higher low (point 5) is above points 1 and 3, creating the third bottom.

Two declines (1 & 3) lessen the right shoulder (5). Then, volume searches are performed on files closest to the neckline between the two highs, 2 and 4, to confirm the reversal trend.

It is also worth noting that the descent into point 3 is less than in 1, and the descent into 5 is less steep than in point 3. Then, they become less aggressive, and downward movement runs out of the stream. When the head and shoulder formation comes in a downtrend, it signifies a significant reversal like in the straight head and shoulder pattern. The strength of these reversal measures is that they raise the amount after break out, which is proportional to the decrease of the pattern before.

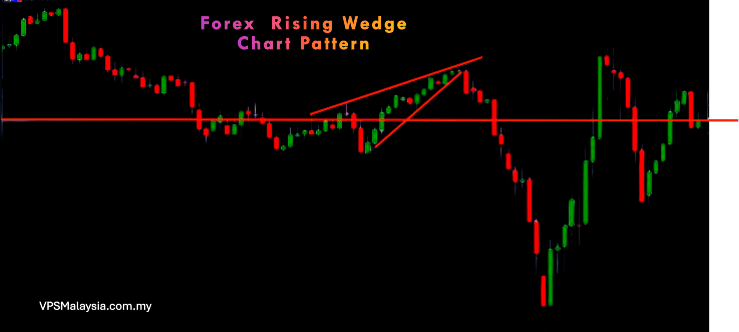

2. Rising Wedge:

It is a reversal of best forex chart patterns formed by ascending trend lines drawing in which one gives highs, and the other offers lows. The upline moves towards the upright, and the slope is less than the lower trend line. It is categorized as a bearish reversal chart pattern.

A rising edge is the opposite of a falling edge; while following a downtrend, rising shows that a weak rally will break through the lower line or continue the prior trend. Breakouts are less common but occur frequently. Breakout is generally expected in the second half of the pattern close to the middle. As the pattern forms, volume is most likely to fall.

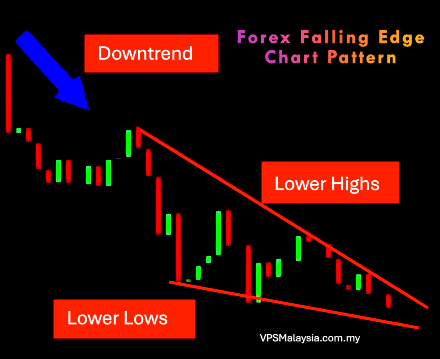

3. Falling Edge:

These chart patterns are drawn by drawing two descending front lines; one gives the highest, and one shows the lowest. They are also categorized as a bullish reversal pattern in which the law of turning represents that the high is lower than the slope of the timeline, which describes the lows and tells that the highs are decreasing more rapidly than the lows.

It takes five reversals to form a good falling wedge pattern. The resulting shape also makes a gradually narrowing wedge, giving this pattern its name. Gaps are extraordinary, which proves the performance before the breakout. Commonly, when a falling wedge is falling and where a falling wedge is following an uptrend, the pattern shows a gradual price decline. In this case, the price will break through the per line, continuing the prior trend. Volume falls during pattern formation.

Are There Any Disadvantages When Trading With Chart Patterns?

Forex patterns work but demand proper risk management, discipline, and confirmation. Where forex bar chart patterns have a lot of benefits, there are some drawbacks of forex bar chart patterns:

1. Sometimes Forex Chart Patterns Deliver Fast Signals:

They don’t work out 100% but are considered a valid charge; partners play out in a manner that is not expected. So, it is vital that traders only take advantage of opportunities where the risk ratio is low.

2. Chart Patterns Can Inspire Subjectivity:

Chart patterns give traders the feel of a market, but this tends to be more subjective than objective trading. With hundreds of patterns, traders develop biases while interpreting them. Subjective trading is riskier. It relies on general guidelines rather than the strict, rule-based system. One trader views a pattern as a continuation, while others see it as a reversal that leads to entirely different trades.

3. Forex Bar Chart Patterns Sometimes Take A Long Time To Form:

Patience is essential for investors, even more so in chart patterns where the signal generated by the chart takes several periods to be confirmed. This burdens traders watching price action play out and feel like some profit is left on the table.

4. Most Of The Best Forex Chart Patterns Are Only Effective For Short-Term:

Some chart patterns give signals that they are valid for a time. Traders only have a small window of opportunity. A slight delay means the trading signal no longer offers an attractive ray or reward proposition.

Conclusion

Forex chart patterns are the best way to track price changes in the forex market and identify their condition. Learning forex chart patterns reduces the risks of falling for forex trading scams and helps anticipate possible changes and arising trade opportunities. For traders looking for forex trading opportunities in Malaysia, using forex chart patterns can help maximize profits.

All forex chart pattern PDFs and PDF chart pattern books give handy references for study. While they provide compelling trade signals, it is essential to exercise strict risk management as they are not 100% reliable—multiple trading methods for finding entries and stop levels for forex investment. For the best forex chart patterns, head and shoulder, triangle to cup, and handle chart patterns are precious. The advantages of chart patterns outweigh their disadvantages.

Many of the best forex chart patterns that form market traders are given to build and improve their knowledge and skill to benefit from them accurately. If you have any questions, please ask in the comment section below!

Boost your trading with Forex chart patterns. Understand key tools for higher profits through our Forex VPS Hosting!

Leave a Reply